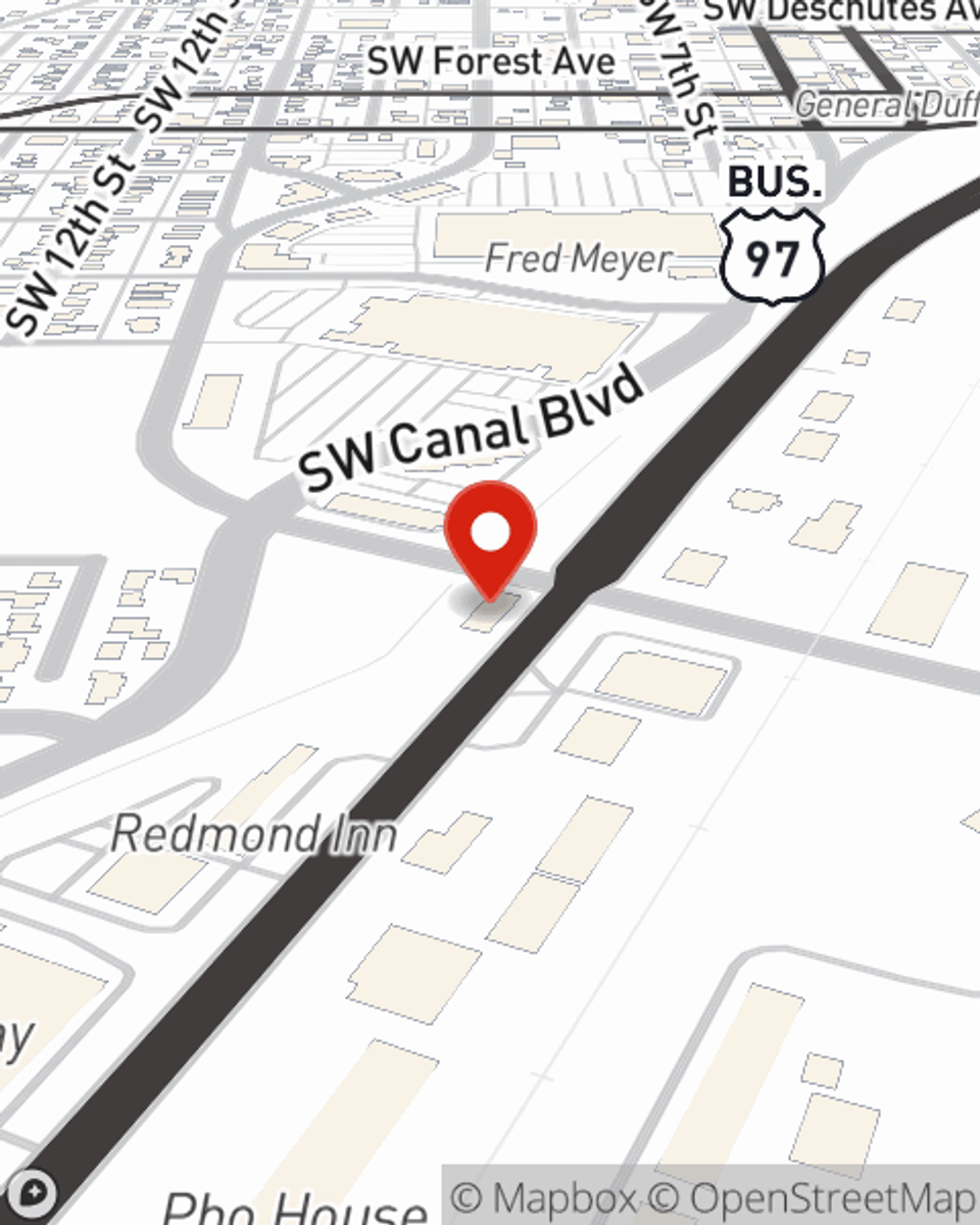

Business Insurance in and around REDMOND

Researching protection for your business? Search no further than State Farm agent Jake Waardenburg!

This small business insurance is not risky

Your Search For Outstanding Small Business Insurance Ends Now.

Running a small business requires much from you. Finding the right coverage should be the least of your worries. State Farm insures small businesses that fall under the umbrella of trades, specialized professions, contractors and more!

Researching protection for your business? Search no further than State Farm agent Jake Waardenburg!

This small business insurance is not risky

Get Down To Business With State Farm

You are dedicated to your small business like State Farm is dedicated to dependable insurance. That's why it only makes sense to check out their coverage offerings for commercial liability umbrella policies, commercial auto or artisan and service contractors.

With over 300+ businesses eligible to be insured by State Farm, look no further for your business coverage needs. Agent Jake Waardenburg is here to help you explore your options. Visit today!

Simple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Jake Waardenburg

State Farm® Insurance AgentSimple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.